Navigating Executor Liability and California Probate Sales

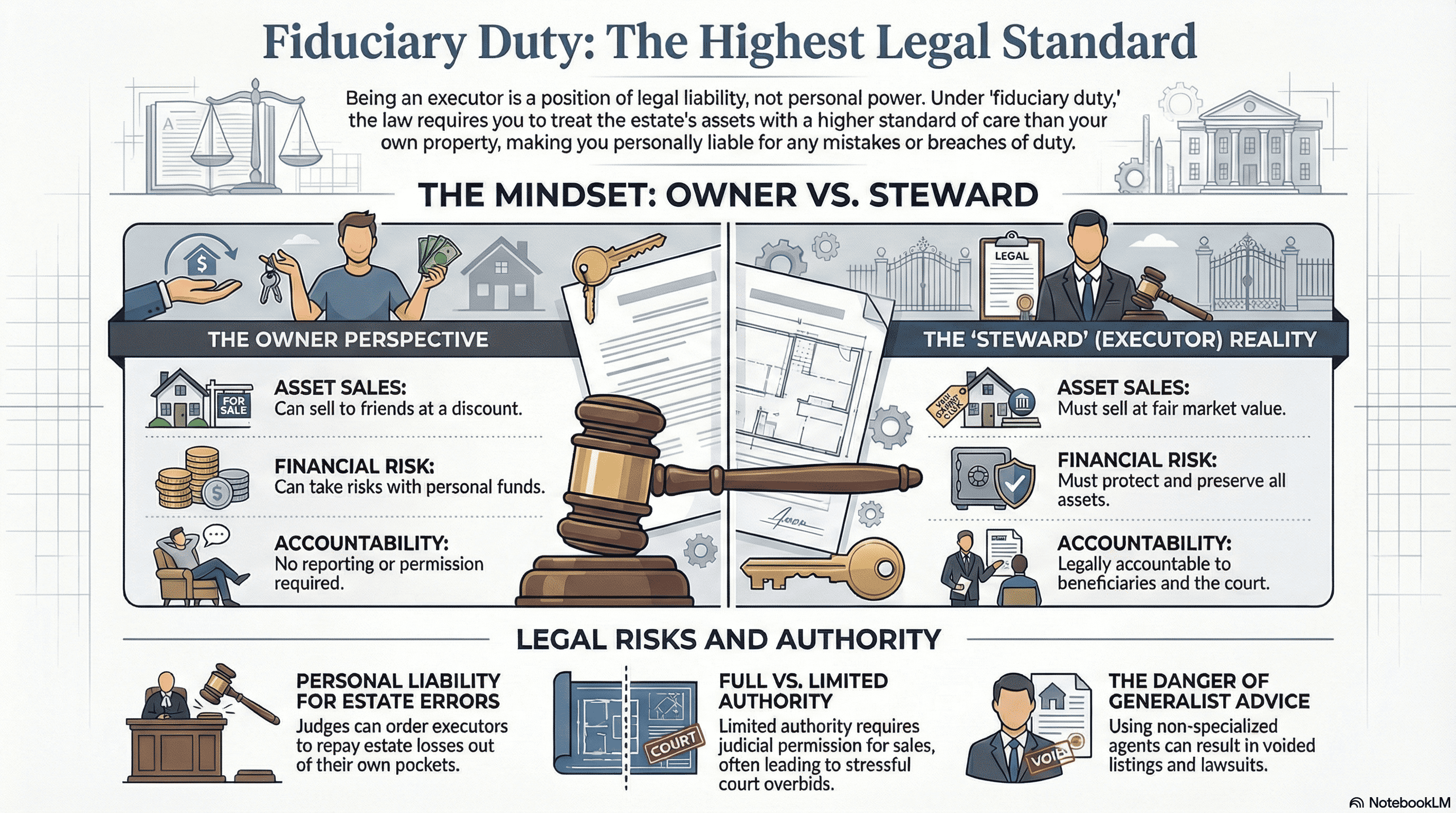

The Legal Shadow: Why Your Personal Bank Account is at Risk

Adults vs. Toddlers: The Procedural Trap That Kills Estate Value

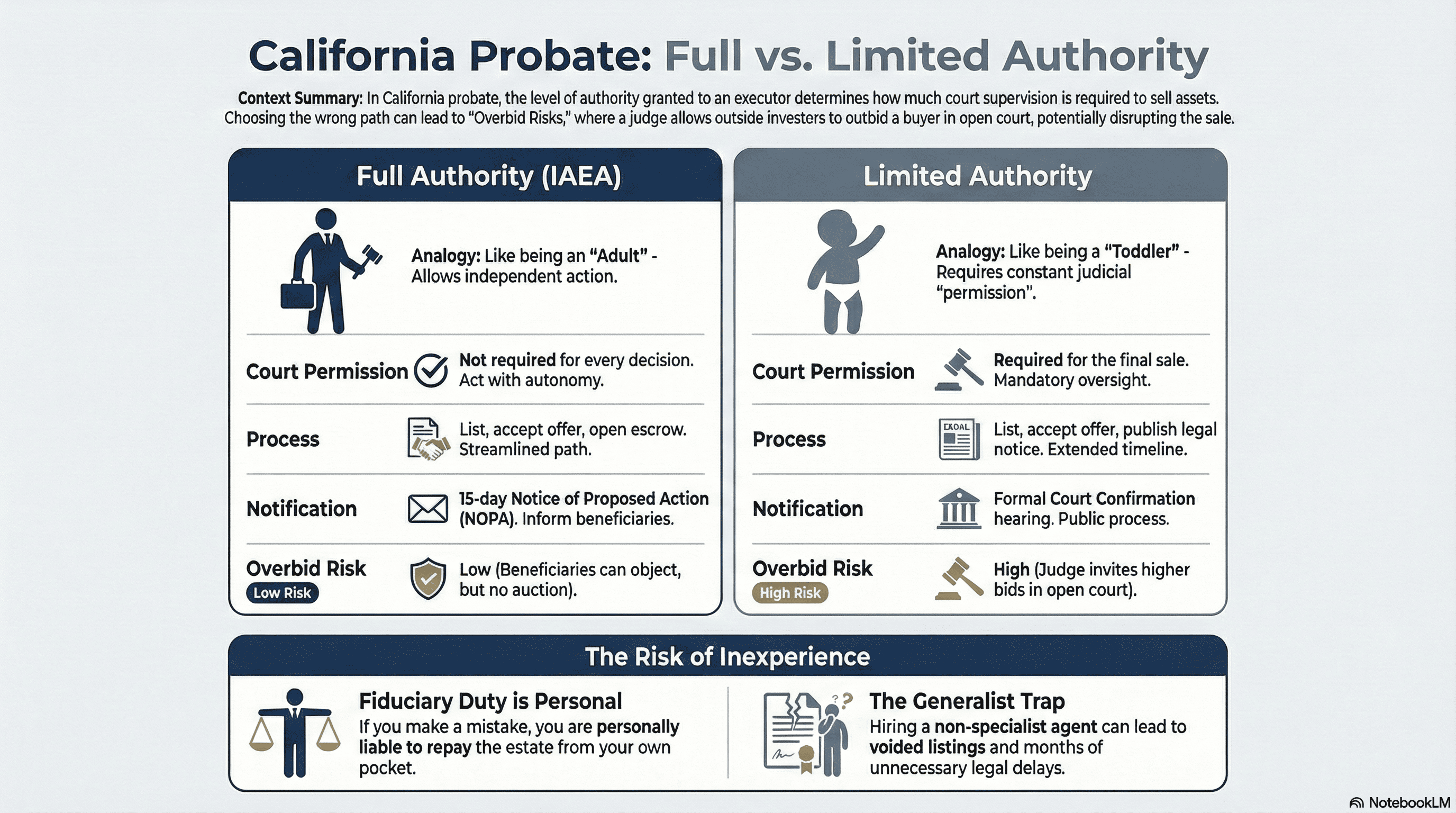

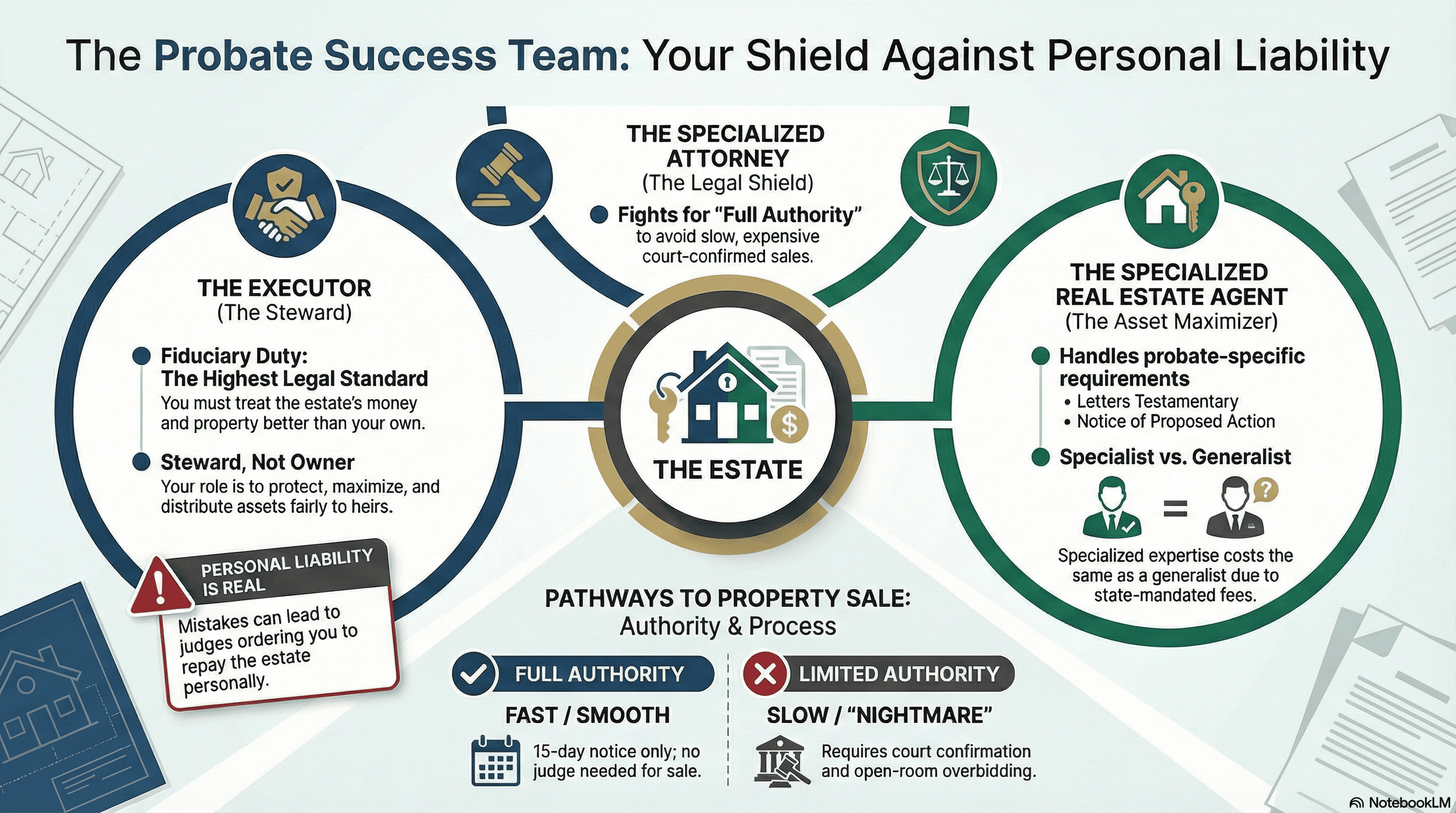

The success of a real estate sale in probate often hinges on a technicality most families ignore until it’s too late: the level of authority granted by the court.

The difference between "Full Authority" and "Limited Authority" is the difference between a smooth closing and a public auction nightmare.

Limited authority is a functional nightmare for executors. Because of the "Court Overbid Process," a buyer can have their offer accepted, wait months for a hearing, and then lose the house in seconds to someone who bids a few dollars more in the courtroom.

This uncertainty drives away "traditional buyers", families looking for a home in Orange County—and instead attracts predatory investors who specialize in buying court-confirmed properties at a discount because they know the competition is decimated.

This lack of competition almost always results in a lower final price for the heirs.

The Ferrari Fee: Why “Cheap” Help is a Legal Impossibility

The $400,000 Mistake: The Danger of the Friendly Generalist

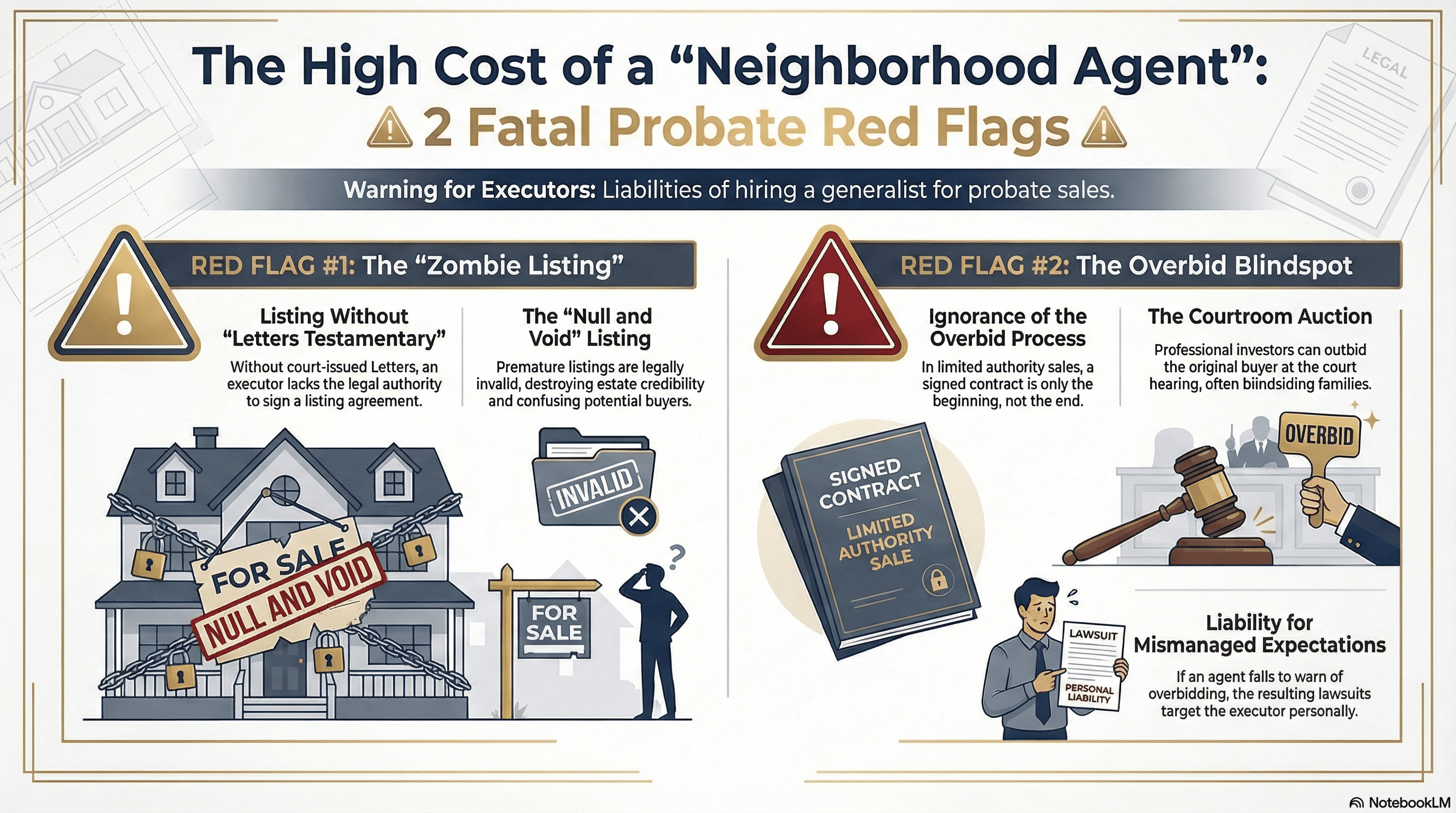

The Red Flags: Why Your Neighborhood Agent is a Liability

Hiring a "neighborhood agent" who primarily sells standard residential homes can expose an executor to massive legal risk. If your agent exhibits either of these two behaviors, fire them immediately:

The Executor’s Shield: Three Golden Rules of Estate Preservation

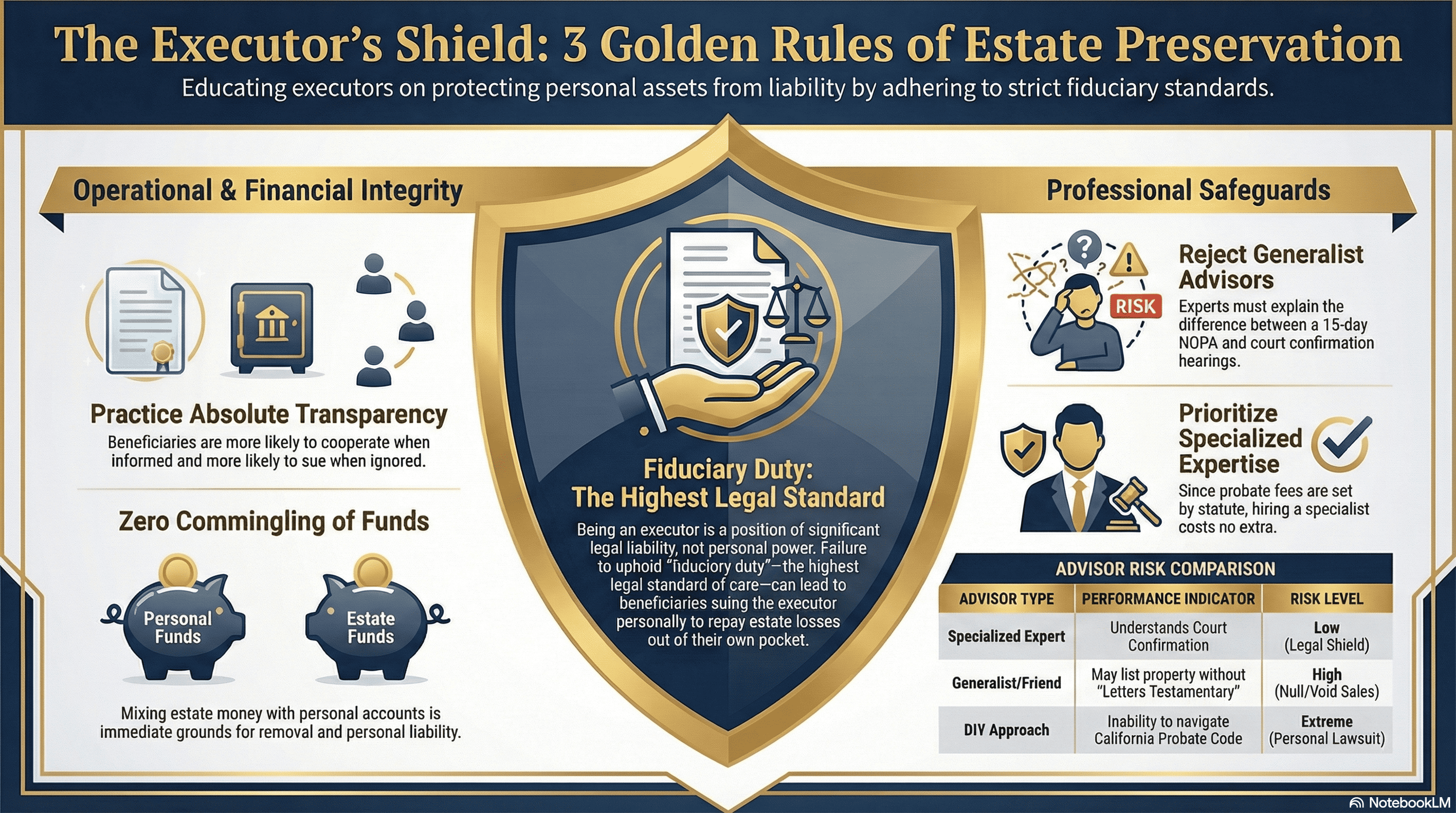

To protect your personal assets and fulfill your fiduciary duty, you must adhere to these three principles:

- Practice Absolute Transparency: Never hide information. As attorney Cheryl Barrett warns, "Beneficiaries smell money." They are far more likely to cooperate when they feel informed; they are far more likely to sue when they feel ignored.

- No Commingling of Funds: Never, under any circumstances, mix estate money with your personal accounts. This is an immediate ground for removal by the court and a primary trigger for personal liability.

- • Reject Generalists: If an agent or attorney cannot explain the specific difference between a 15-day NOPA and a court confirmation hearing, they are a liability. They are not just "inexperienced", hey are a threat to your personal financial safety.

Conclusion

As you move forward, ask yourself: Are you prepared to defend your decisions in front of a judge and a room full of heirs who "smell money"?

Protect your personal assets and master the probate process.

Let Aragone & Associates guide you through the process, helping to make the transition seamless. Call us at 949-415-4784 or email us at [email protected].

Disclaimer: We are not real estate attorneys, and the information provided should not be considered legal advice. We strongly recommend consulting with qualified legal counsel regarding your specific situation. If you do not currently have legal representation, feel free to reach out to us, and we can connect you with one of our trusted attorneys.