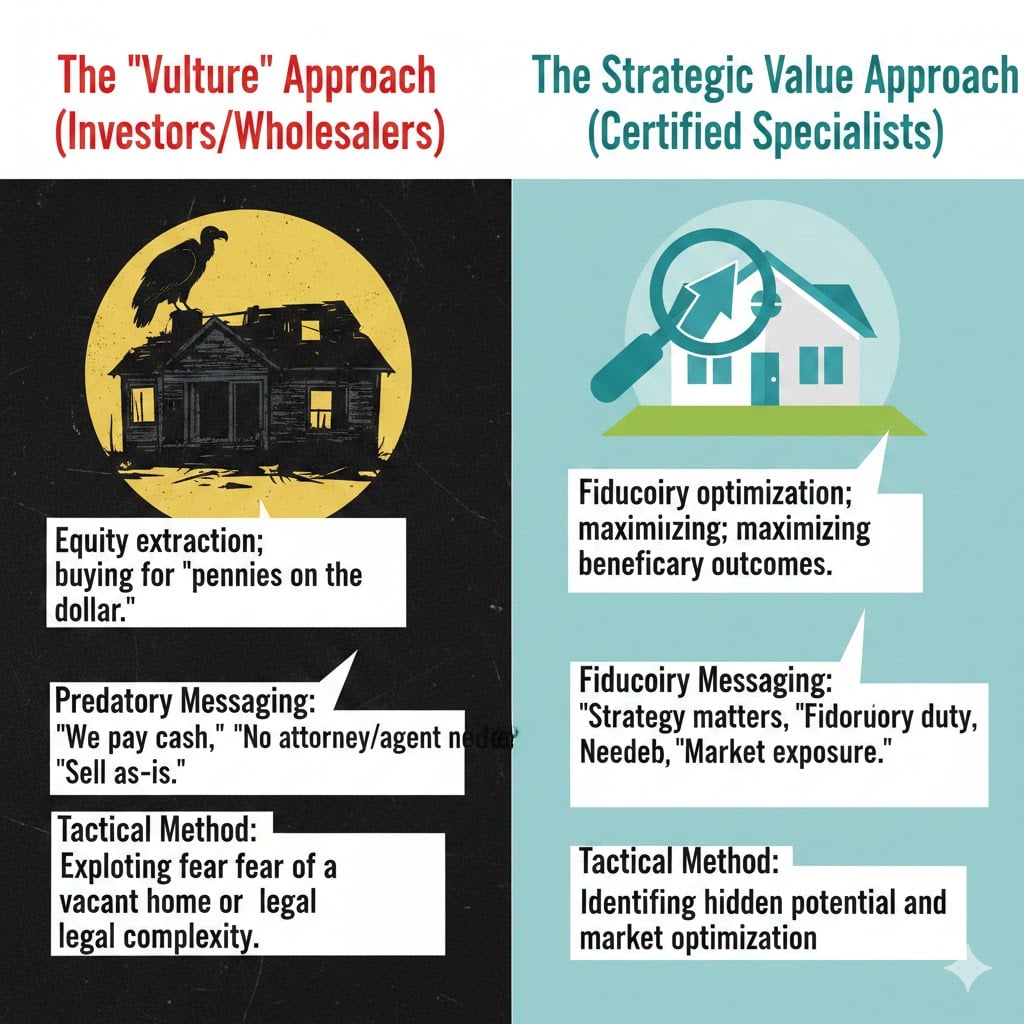

The "vulture" ecosystem relies on predatory scripts designed to make you feel that the property is a burden. They may even resort to outright misrepresentation. In a landmark case in Newport Beach, an estate was pressured by investors who claimed the property was a "tear-down" and offered a low "as-is" cash price. By rejecting that narrative and instead applying strategic cleaning, targeted improvements, and professional market exposure, the estate eventually sold for $2 million more than that initial investor offer.

Remember: unsolicited solicitation is a confirmation of your asset’s value, not a mandate for immediate action. Do not let a stranger determine the value of your legacy.

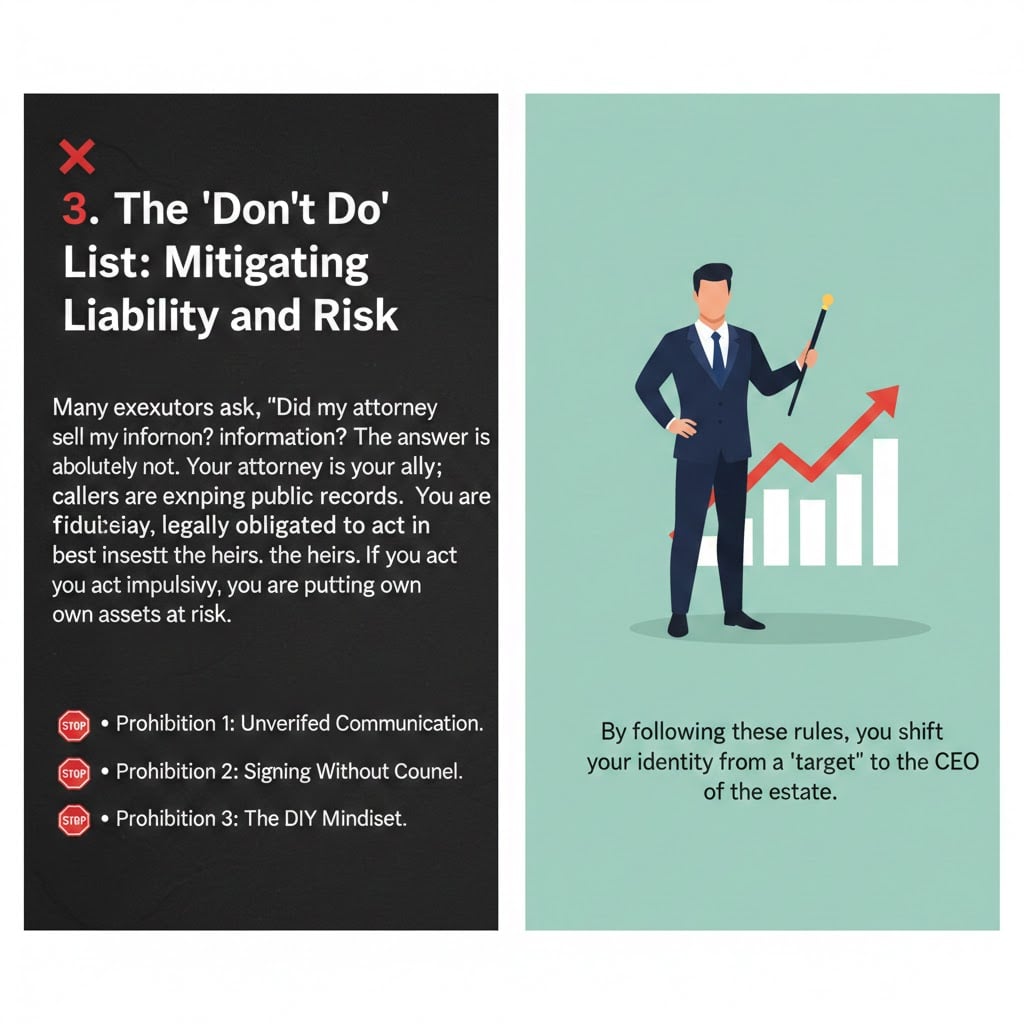

- The "Don't Do" List: Mitigating Liability and Risk

Many executors ask, "Did my attorney sell my information?" because the phone starts ringing the moment they leave the law office. The answer is absolutely not. Your attorney is your ally; the callers are simply exploiting public records. As the executor or administrator, you have stepped into a "thankless job" with high personal liability.

You are now a fiduciary, legally obligated to act in the best interest of the heirs. If you act impulsively, you aren't just losing money; you are putting your own assets at risk.

To shield yourself, adhere to these three prohibitions:

- Prohibition 1: Unverified Communication.Ignore unknown calls and texts. These are high-pressure environments where agents and investors who do not specialize in probate will try to corner you.

- Prohibition 2: Signing Without Counsel.Never sign a listing agreement, letter of intent, or sale contract in the first week. If you rush into a sale below market value, other heirs can sue you personally for a breach of fiduciary duty. Your signature is a legal commitment that requires a strategic buffer.

- Prohibition 3: The DIY Mindset.Attempting to sell to a "friend or neighbor" to save on commissions is the definition of "stepping on a dollar to pick up a penny." In many jurisdictions, probate attorney fees are set by statute—you don't save money by cutting corners; you only increase your liability and decrease the final payout.

By following these rules, you shift your identity from a "target" to the CEO of the estate.

- The Week One Action Plan: Building Your Strategic Wall

The first week is about moving from defense to offense. You must build a "strategic wall" that allows you the space to grieve while your professional team manages the noise. This is a marathon, not a sprint.

Your Three-Step Strategy:

- Traffic Control:Formally direct all inquiries and legal correspondence to your attorney. They are your primary point of contact for the legal docket and the first line of defense against data scrapers.

- Perimeter Security:Ensure the asset is physically secure. Lock the doors and change the locks if necessary. Do not worry about cleaning or clearing personal property in the first 48 hours—focus entirely on securing the physical perimeter.

- Professional Buffer:Engage a Probate Certified real estate agent. This professional acts as your primary shield. When investors or agents call, you must use a firm script : "I have representation and a team in place. Please speak to them." Then, hang up.

- Conclusion and Call to Action

The first 48 hours of probate are the most volatile, but they do not have to be the most stressful. By understanding that your privacy has become public, you can take the necessary steps to protect your family’s equity from those looking to take it for pennies on the dollar. Strategy matters, and you deserve a team that treats your family’s legacy with the respect it deserves.

Take Control of the Probate Journey

This is Episode 1 of our 12-week series: "From Grief to Growth: Mastering the Probate Sale." Don’t navigate this high-stakes environment alone. Click the link below to read our full strategic guide and download the "12-Step Probate Success Checklist" to ensure you are fulfilling your fiduciary duties while maximizing the estate's value.

[Download the 12-Step Probate Success Checklist & Read the Full Blog Post]