In Anaheim Hills, a family believed they had successfully navigated the grueling process of clearing out a relative’s home. They had spent weeks sorting, donating, and hauling away debris. They were confident the property was vacant and ready for the next stage of a probate sale.

However, our team performed one final, systematic sweep of the house. In the back of a deep closet, hidden under years of neglect, we discovered an old, unremarkable suitcase.

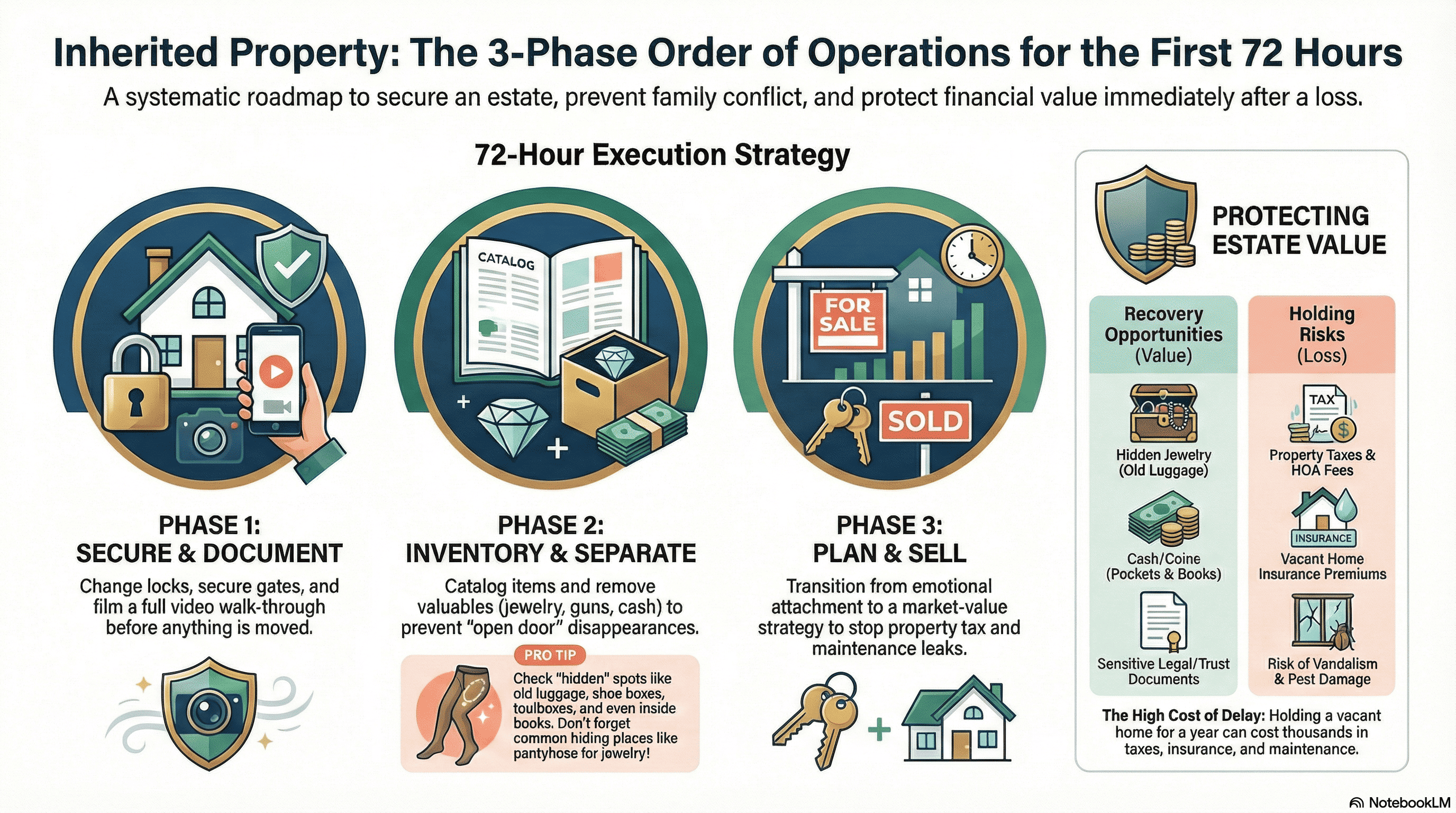

The difference between securing an estate’s legacy and losing it forever often comes down to the strategy implemented within the first 72 hours of inheritance.

Whether you are managing a trust or estate property, navigating a conservatorship transaction, or preparing a high-stakes luxury listing, the outcome is determined by your order of operations.

As a fiduciary or heir, your first three days should be defined by technical precision, not emotional reaction.

Takeaway 1: Why "Secure" Must Come Before "Sort"

- Controlling Access and Securing Entry Points

- Locks and Windows: Change the locks immediately. Do not rely on "who might have a key." Ensure every window latch is functional and locked.

- Side Gates: This is vital for properties with pools or those that provide easy backyard access to neighbors.

- Garage Access: A critical and often forgotten step is to unplug the automatic garage door opener cord.

2. The Critical Step: Separating Valuables

- Firearms: Guns must be secured or legally transferred immediately.

- Sensitive Documents: Tax returns, bank statements, insurance paperwork, and checkbooks.

- Estate Paperwork: The original Trust or Will documents, safe keys, and safe codes.

- Liquid Assets: Coin collections, stamp collections, and loose cash.

This level of security is not about a lack of trust in the family; it is about protecting the estate from "grief turning into conflict." When an item goes missing without a record, it breeds suspicion that can destroy family relationships for decades.

Takeaway 2: The "Treasure Hunt" Hotspots You’re Likely Overlooking

- Our team is systematic in checking the "Treasure Hunt Hotspots":

- Old Luggage and Garment Bags: As demonstrated in the Anaheim Hills case, these are classic hiding spots.

- Shoe Boxes and Hidden Closet Corners: Deep shelves often hide envelopes of cash or small jewelry boxes.

- Kitchen Tins and Junk Drawers: Value is frequently tucked into mundane canisters.

- Tool Boxes: Look past the wrenches; these are frequently used as makeshift safes.

- Behind Framed Artwork: We often find documents or cash taped to the back of frames or hidden inside the backing.

- Inside Books: This is the primary location for finding old bonds or high-denomination cash.

- By documenting everything, including sheds and attic access—before anything is moved, we ensure the process remains "calmer, clearer, and fair."

Takeaway 3: The Danger of the "Open Door" Policy

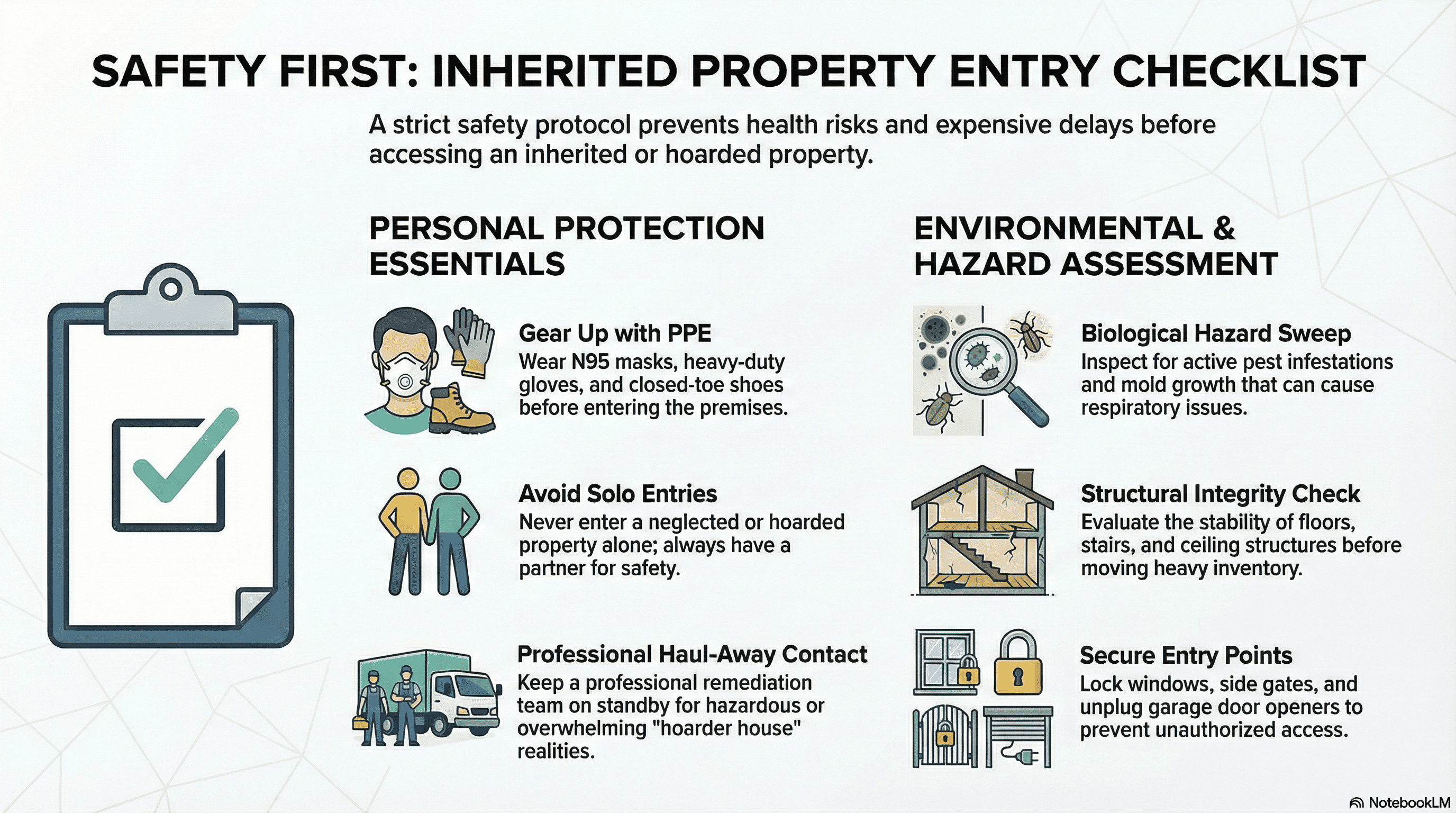

Takeaway 4: The "Hoarder House" Reality and Safety First

Safety Protocols for Initial Entry:

- PPE: Full-body protection, including heavy-duty gloves and N95 masks, is non-negotiable.

- Footwear: Closed-toe, puncture-resistant shoes are required.

- Environmental Hazards: Be alert for pests, mold, and structural hazards hidden under debris. A floor that looks solid may be compromised by years of weight or moisture.

Entering these environments without the right equipment can lead to respiratory issues, injury, and expensive delays in the sale process.

Takeaway 5: The "Silent Drain" of Delaying the Sale

- The Mathematical Reality of Holding Costs:

- Property Taxes: These accrue daily and are often significant in Orange County.

- Insurance Premiums: Vacancy risks result in much higher premiums. If you fail to notify your insurer the home is empty and a pipe bursts, they may deny the claim entirely.

- Utilities and Maintenance: Landscaping and climate control costs offer zero return on an empty house.

- Risk of Damage: The longer a house sits, the higher the risk of vandalism, squatters, leaks, and pest infestations.

- Mortgage Interest: If the home isn't owned outright, the monthly interest payments alone can dwarf any "hidden treasure" found inside.

Conclusion: A System for Peace of Mind

- Watch: See the full Anaheim Hills story and more expert tips on the [Aragone & Associates YouTube Channel].

- Subscribe: Visit our Blog Main page to sign up for our newsletter and receive in your inbox our latest blogs articles.

- Listen: Catch the latest episodes of the Aragone & Advisors podcast on Spotify for deep dives into Orange County real estate strategy.

- Connect: Follow us for daily insights and probate advice on [Instagram], [Facebook], and [LinkedIn].